6 Steps to Retirement Success

Retirement planning can be challenging, we’ve outlined what we feel are 6 steps to retirement success. Talk to us about a complimentary comprehensive review of your retirement plan.

Retirement planning can be challenging, we’ve outlined what we feel are 6 steps to retirement success. Talk to us about a complimentary comprehensive review of your retirement plan.

You most likely do, but the more important question is, ‘What kind?’ Whether you’re a young professional starting out, a devoted parent or a successful CEO, securing a life insurance policy is probably one of the most important decisions you will have to make in your adult life. Most people would agree that having financial safety nets in place is a good way to make sure that your loved ones will be taken care of when you pass away. Insurance can also help support your financial obligations and even take care of your estate liabilities.

The importance of a financial plan. Working with us to create your financial plan helps you identify your long and short term life goals.Talk to us to see how we can help you.

For most of the people, a watertight estate planning means finding the best ways to equip themselves for contingencies, reduce the tax liability for their estate, and signing up for investment plans to ensure that their money continues to earn money for them.

Ontario Finance Minister Charles Sousa delivered the province’s 2017 budget on April 27, 2017. Learn what the budget means for small business owners and individuals.

Being prepared for your child in case you’re not around is important, we outline some of the key factors of creating an “Accessible Plan”

Finance Minister Bill Morneau delivered the government’s 2017 federal budget on March 22, 2017. The budget expects a deficit of $23 billion for fiscal 2016-2017 and forecasts a deficit of $28.5 billion for 2017-2018. Learn what the budget means for families

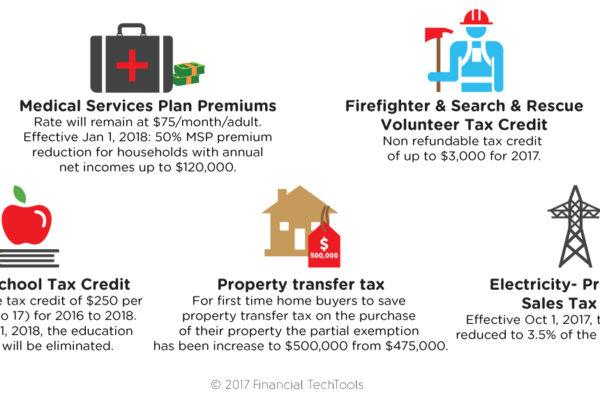

BC Finance Minister, Michael de Jong delivered the province’s 2017 budget on Feb. 21, 2017. Learn what the budget means for small business owners and individuals.

Retirement planning can be challenging, we’ve outlined what we feel are 6 steps to retirement success. Talk to us about a complimentary comprehensive review of your retirement plan.

We outline the best way to purchase mortgage insurance.

Mutual funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc.

Insurance products are offered through PPI Management Inc., a national licensed insurance marketing organization that support independent advisors with their business, and through multiple insurance companies.