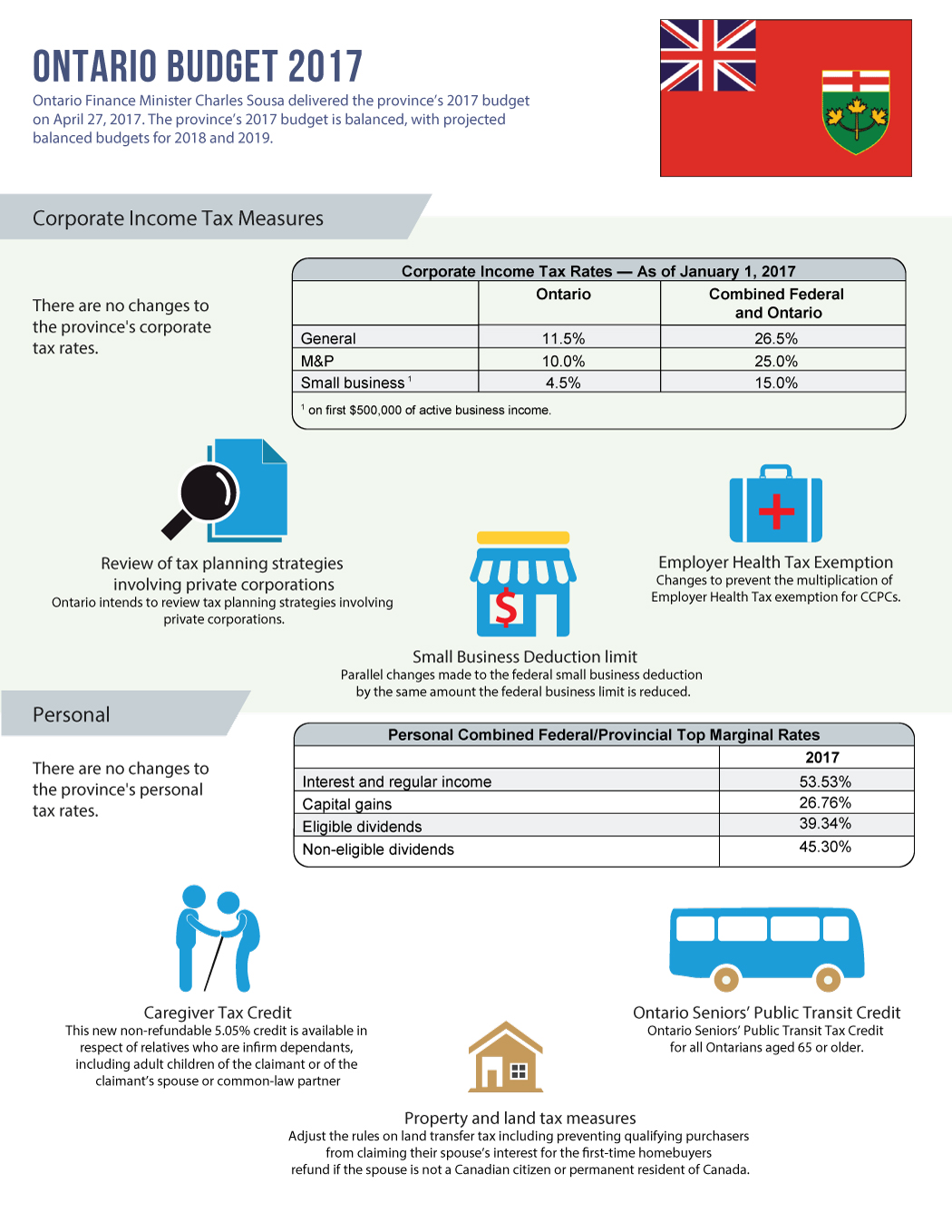

Ontario Finance Minister Charles Sousa delivered the province’s 2017 budget on April 27, 2017. The province’s 2017 budget is balanced, with projected balanced budgets for 2018 and 2019.

No changes to corporate taxes were announced.

| Corporate Income Tax Rates- As of January 1, 2017 | ||

| Ontario | Combined Federal & Ont | |

| General | 11.5% | 26.5% |

| M&P | 10.0% | 25.0% |

| Small Business* | 4.5% | 15.0% |

| *on first $500,000 of active business income | ||

No changes to personal taxes were announced.

| Personal Combined Federal/Provincial Top Marginal Rates | |

| 2017 | |

| Interest and regular income | 53.53% |

| Capital gains | 26.76% |

| Eligible dividends | 39.34% |

| Non-eligible dividends | 45.30% |

Please don’t hesitate to contact us if you have any questions.

Mutual funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc.

Insurance products are offered through PPI Management Inc., a national licensed insurance marketing organization that support independent advisors with their business, and through multiple insurance companies.