What are the chances?

Identifying risk through insurance.

Identifying risk through insurance.

Retirement planning can be a complex process for us all, but if you are the owner of a small business it may can get even more complicated, due to the various factors and circumstances that you have to take into consideration. A common mistake made by small business owners is reinvesting extra money to grow their business, at the expense of putting it aside to save for their retirement.

Retirement planning can be challenging, we’ve outlined what we feel are 6 steps to retirement success. Talk to us about a complimentary comprehensive review of your retirement plan.

Working with a professional to help you to make sense of your finances can be a wise move, but for this relationship to work effectively it is important that you understand what to expect from your financial advisor.

The 2018 Ontario budget features a number of new measures and billions of dollars of enhanced spending across the spectrum, as announced by the province’s Finance Minister, Charles Sousa. Read on for some of the key proposals.

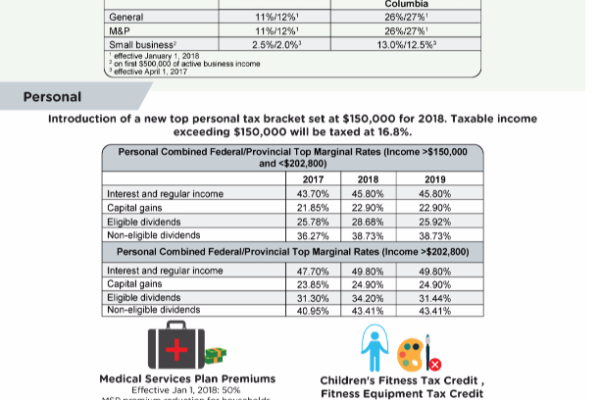

The government’s 2018 federal budget focuses on a number of tax tightening measures for business owners. It introduces a new regime for holding passive investments inside a Canadian Controlled Private Corporation (CCPC). (Previously proposed in July 2017.)

You most likely do, but the more important question is, ‘What kind?’ Whether you’re a young professional starting out, a devoted parent or a successful CEO, securing a life insurance policy is probably one of the most important decisions you will have to make in your adult life. Most people would agree that having financial safety nets in place is a good way to make sure that your loved ones will be taken care of when you pass away. Insurance can also help support your financial obligations and even take care of your estate liabilities.

It has certainly been a busy week in terms of announcements regarding financial policies for small businesses. Following the series of proposed tax reforms that the government announced back in July, various tweaks and changes have subsequently been made, owing, perhaps in part, to confusion and frustration expressed among the small business community. We have provided a brief summary of the changes in this article and infographic.

The importance of a financial plan. Working with us to create your financial plan helps you identify your long and short term life goals.Talk to us to see how we can help you.

BC Finance Minister Carole James delivered the province’s 2017 budget update on Sept. 11, 2017. The budget anticipates a surplus of $46 million for the current year, $228 million in 2018-2019 and $257 million in 2019-2020. As a result of the provincial election on April 11, 2017, the measures previously announced were not fully enacted.

Mutual funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc.

Insurance products are offered through PPI Management Inc., a national licensed insurance marketing organization that support independent advisors with their business, and through multiple insurance companies.