Government of Canada to allow up to $400 for home office expenses

For the 2020 tax year, the Government of Canada introduced a temporary flat rate method to allow Canadians working from home this year due to Covid-19 to claim expenses of up to $400.

For the 2020 tax year, the Government of Canada introduced a temporary flat rate method to allow Canadians working from home this year due to Covid-19 to claim expenses of up to $400.

The Canada Recovery Benefit (CRB) is now open for applications.

If you are eligible for the CRB, you can receive $1,000 ($900 after taxes withheld) for a 2-week period.

If your situation continues past 2 weeks, you will need to apply again. You may apply up to a total of 13 eligibility periods (26 weeks) between September 27, 2020 and September 25, 2021.

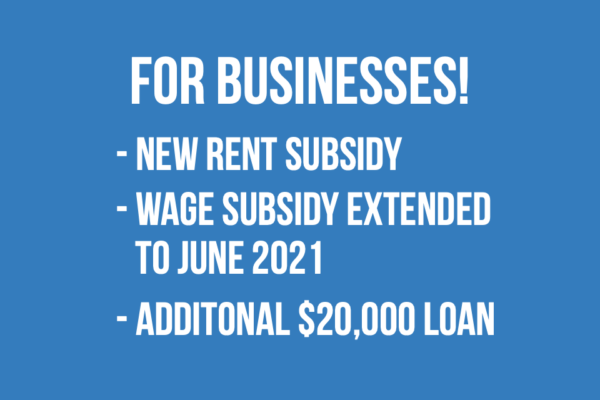

Great news for businesses! The new Canada Emergency Rent Subsidy will be available directly to business owners who need rent relief. The Wage Subsidy has been extended to June 2021. And the CEBA has been expanded to provide up to $20,000 interest-free loan.

On August 20th, the Federal Government announced the extension of the Canada Emergency Response Benefit (CERB) by one month and the transition to the Canada Recovery Benefit, Canada Recovery Sickness Benefit, Canada Recovery Caregiving Benefit and a simplified EI.

The intention for our “Guide to Covid-19: Government Relief Programs in Canada” is to help businesses and individuals to cut through the noise and make sure they’re getting all the help they can receive from the federal and provincial programs.

Mutual funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc.

Insurance products are offered through PPI Management Inc., a national licensed insurance marketing organization that support independent advisors with their business, and through multiple insurance companies.