Understanding Target Loss Ratio and Your Group Benefits Plan

Unlock the mysteries of your group benefits plan! Discover how the target loss ratio (TLR) can influence your premiums and what it means for your company’s future. Dive in now!

Unlock the mysteries of your group benefits plan! Discover how the target loss ratio (TLR) can influence your premiums and what it means for your company’s future. Dive in now!

For incorporated professionals, making sure your business is financially protected can be overwhelming. Incorporated Professionals face a unique set of challenges when it comes to managing risk. Insurance can play an important role.

While it’s great to have group coverage from your employer or association, in most cases, people don’t understand the that there are important differences when it comes to group life insurance vs. self owned life insurance.

For business owners, making sure your business is financially protected can be overwhelming. Business owners face a unique set of challenges when it comes to managing risk. Insurance can play an important role.

Working with a professional to help you to make sense of your finances can be a wise move, but for this relationship to work effectively it is important that you understand what to expect from your financial advisor.

The 2018 Ontario budget features a number of new measures and billions of dollars of enhanced spending across the spectrum, as announced by the province’s Finance Minister, Charles Sousa. Read on for some of the key proposals.

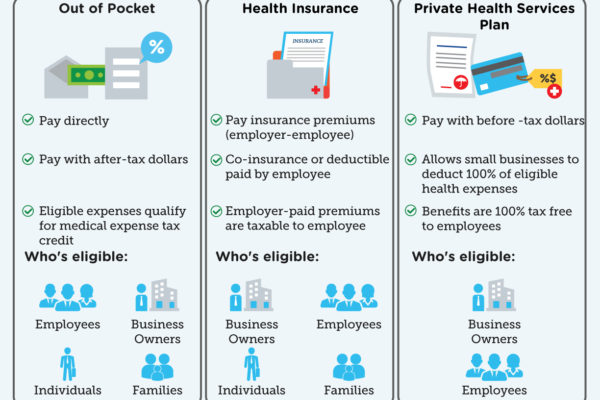

Although we enjoy health care benefits in Canada, there are still some benefits that are not covered by the government. We outline strategies to pay for these benefits.

Although we enjoy health care benefits in Canada, there are still some benefits that are not covered by the government. We outline strategies to pay for these benefits.

Mutual funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc.

Insurance products are offered through PPI Management Inc., a national licensed insurance marketing organization that support independent advisors with their business, and through multiple insurance companies.